The world of cryptocurrency has taken the financial arena by storm, offering unprecedented opportunities for traders and investors alike. One of the platforms that have gained significant attention for facilitating crypto trading is Pocket Option. This article delves deep into the nuances of Crypto Trading Pocket Option crypto trading Pocket Option, providing insights, strategies, and best practices to thrive in this vibrant market.

Understanding Pocket Option

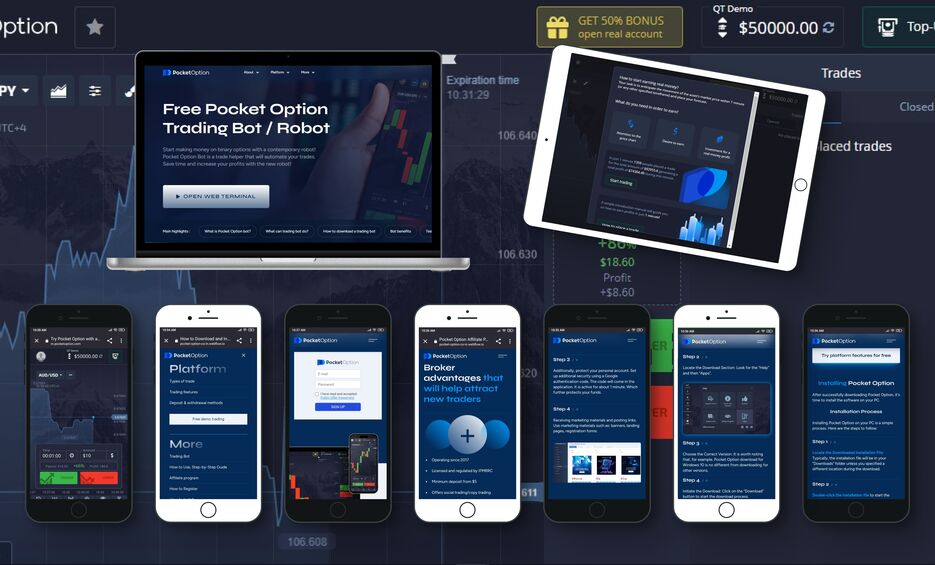

Pocket Option is a popular trading platform that has made a name for itself by providing a user-friendly interface for trading various assets, including cryptocurrencies. The platform allows traders to engage in binary options trading, offering a unique way to profit from market movements. Different from traditional trading, where assets are bought and sold, binary options allow traders to predict price movements within a specific timeframe. If the prediction is correct, they receive a fixed return on their investment.

Getting Started with Crypto Trading on Pocket Option

For those looking to venture into crypto trading on Pocket Option, the journey begins with a few fundamental steps:

- Create an Account: Registering for an account on Pocket Option is straightforward. Users need to provide an email address, create a password, and verify their account.

- Deposit Funds: Once the account is set up, traders must deposit funds. Pocket Option supports various payment methods, including credit cards, bank transfers, and cryptocurrencies.

- Select Assets: The platform offers a range of cryptocurrencies to trade, including Bitcoin, Ethereum, Litecoin, and others. Traders can diversify their portfolios by selecting multiple assets.

- Choose Trade Type: The main trading product on Pocket Option is binary options. Traders can predict whether the price of a selected asset will rise or fall within a set timeframe.

- Analyze the Market: Utilizing technical and fundamental analysis will help traders make informed decisions. Pocket Option provides various tools and indicators to assist in market analysis.

- Start Trading: With everything in place, traders can begin executing trades. It’s crucial to start small and gradually increase investment as confidence and skill grow.

Strategies for Successful Crypto Trading

Success in crypto trading on Pocket Option relies heavily on strategy. Here are some effective approaches:

1. Trend Following

One of the most common trading strategies is trend following. Traders identify upward or downward market trends and make predictions based on the continuing direction of the trend. Various indicators, such as moving averages or the Relative Strength Index (RSI), can help identify trends.

2. News Trading

The cryptocurrency market is highly responsive to news and geopolitical events. Traders can leverage news by making trades based on anticipated market reactions. Staying updated with the latest news can provide a competitive edge, allowing traders to capitalize on price volatility.

3. Range Trading

Range trading involves identifying key support and resistance levels. Traders make predictions based on whether they believe the price will bounce off these levels or break through them. This requires a keen understanding of market dynamics and the ability to read charts effectively.

Managing Risk in Crypto Trading

Risk management is a critical component of any trading strategy, especially in the volatile world of cryptocurrency. Here are some key practices to minimize risk:

- Set Stop-Loss Orders: This feature allows traders to limit their potential losses by automatically closing a trade at a predetermined price.

- Use Proper Position Sizing: Determining the right amount to invest in a trade relative to the overall portfolio ensures that no single trade has the potential to cause significant losses.

- Diversify Investments: By spreading investments across various assets, traders can reduce the risk associated with specific cryptocurrencies.

The Role of Technical Analysis in Crypto Trading

Technical analysis plays a vital role in crypto trading on Pocket Option. Traders use past price data, charts, and various indicators to forecast future price movements. Some popular technical indicators include:

- Moving Averages: These help smooth price data to identify trends over a specific period.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Bollinger Bands: These provide a relative definition of high and low prices, indicating volatility and overbought/oversold conditions.

Leveraging Pocket Option Features

Pocket Option comes equipped with various features to enhance the trading experience:

1. Demo Account

The demo account feature allows novice traders to practice their skills without risking real money. This is a great way to understand how the platform works and test different trading strategies.

2. Social Trading

This unique feature allows traders to follow and copy the trades of successful traders. It provides an opportunity for less experienced traders to learn and gain insights from seasoned professionals.

3. Mobile Application

Pocket Option’s mobile app ensures that traders can access the platform anytime, anywhere. This flexibility is crucial in the fast-paced world of crypto trading, where market conditions can change rapidly.

Conclusion

Crypto trading on Pocket Option opens up a world of possibilities for traders seeking to capitalize on the cryptocurrency market’s volatility. By implementing effective strategies, managing risk, and leveraging the platform’s features, traders can enhance their chances of success. However, as with any form of trading, it’s important to stay informed, continuously learn, and evolve with the market. Whether you’re a novice or an experienced trader, tapping into the potential of crypto trading Pocket Option can help you navigate this exhilarating financial landscape.